Medicare Supplement Plans

There are twelve Medicare Supplement Plans.

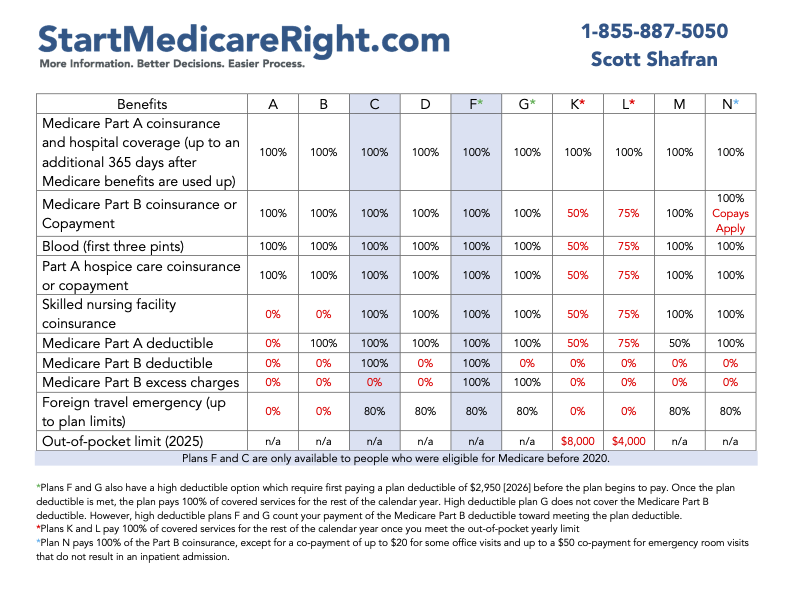

Each plan is standardized so that you can truly compare "apples to apples" when you compare prices. For instance, if you like the popular Medicare Supplement Plan G, if you get quotes from three different companies for Plan G - you can rest assured that you are looking at the exact same insurance coverage.

Below, you'll find information in the following order.

You'll find information for Plan F, Plan G, and Plan N first - as these are the three most popular Medicare Supplement Plans. (Note: If you are new to Medicare, you probably will not be able to enroll in Plan F unless you were eligible prior to 2020)

Then, you'll find information for the other nine plans - Plan A, Plan B, Plan C, Plan D, Plan Hi-F (High-Deductible Plan F), Plan Hi-G (High-Deductible Plan G), Plan K, Plan L, & Plan M.

Plan F

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. Let's take a look at Plan F first, as it is the most popular Medicare Supplement plan.

Medicare Supplement Plan F is the most comprehensive Medicare supplement plan available.

Because it is so comprehensive and covers so much - it is also the most expensive Medicare Supplement plan available.

Why is Plan F So Popular?

A lot of people choose to purchase a Medicare Supplement Plan F because they want to eliminate deductibles, co-pays, and co-insurance as much as possible. As you'll see in the chart below - Plan F covers almost all of the bills which are only partially covered by Medicare.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan F (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan F - they all work the same way and are responsible to pay the same bills.

What does Plan F cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay your $1,736 deductible - so that you pay $0.

Even if your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan F will pick up the daily hospital copays of $434 per day and $868 per day - saving you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan F coverage does not "run out" leaving you liable for the bill unless you go beyond 365 reserve days in the hospital - making it a very solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan F will pay the $217 for you up through the 100th day - and you pay $0.

It will pay the full cost of the first three pints of blood - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan F will pay your yearly deductible ($283 in 2026) - so that you pay $0.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B - and if you have Plan F, Plan F will pay the remaining 20% for you - so that you pay $0.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

specialists

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

and many, many more!

(You'll pay $0 for all of these services when approved by Medicare).

Medicare Supplement Plan F will also pay any and all Medicare Part B excess charges - so you pay $0.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and providers do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan F will pay the remaining $80 (20% of $400). Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan F covers Part B Excess Charges, it pays the excess fee of $60 - and you pay $0.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified”)Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan F Covers Emergencies during Foreign Travel if incurred within the first 60 days while traveling outside of the US.

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

You'll pay the first $250 of emergency expenses outside of the US - this is your foreign travel deductible.

After your deducible is met, Plan F will pay 80% of the bills incurred for emergencies outside of the US, and you are responsible for the remaining 20%.

I heard that Plan F is going away. Is that true? If I buy Plan F now, will they just take it away from me later?

Yes and No.

And no, we are not trying to sound like politicians :)

The answer is that, yes, Plan F went away for some people as of January 2020 - but here is the truth. Let's get into the details.

In 2015, congress passed a bill that we refer to as MACRA. MACRA stands for Medicare Access And Chip Reauthorization Act of 2015. This law affected Plan F and Plan C.

If you become eligible for Medicare Part A before January 1, 2020, then insurance companies are allowed to sell you Plan F indefinitely. Plan F is still available for this group of people.

If you already enrolled in a Plan F, or considering it and you were eligible for Medicare prior to January 1, 2020, then you may purchase Plan F and keep it as long as you pay your premium.

The bottom line is this - only people who are not eligible for Medicare until on/after 1/1/2020 are really "losing" the ability to purchase Plan F. If you were eligible for Medicare prior to 1/1/2020 - then you are eligible to purchase Plan F.

After I purchase Medicare Supplement Plan F - can I ever lose Plan F?

All Medicare Supplement plans - including Plan F - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan F - you can keep it for life if you'd like to.

Should I just buy Plan F - because it covers the most - and not consider the other plan options?

Plan F is great and maybe the plan for you - but you may still want to compare a little further. Many times you can get more "bang for your buck" with Plan G or even Plan N. There are a lot of factors that go into a decision on which plan to get, and which company to get it from, so we highly recommend that you connect with our office and we can walk you through some specifics, based on your location, age, gender, etc.

We have a lot of clients who love the convenience of Plan F - and if you decide that Plan F is the right plan for you, then we will certainly help you with enrollment and any future service needs.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan F written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

Plan G

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've covered Plan F. Now, let's take a look at Plan G, as it is a very popular Medicare Supplement plan.

Medicare Supplement Plan G covers almost as much as Plan F. The only difference between the two plans is that Plan G does not cover the Medicare Part B deductible, which is $283 in 2026.

Because Plan G often costs $20-30 less per month in premium dollars - many see the value in choosing to purchase Plan G, save $240-360 per year in premium, and pay the $283 deductible on their own (from the savings).

Why is Plan G Popular?

A lot of people choose to purchase a Medicare Supplement Plan G because they want to eliminate co-pays and co-insurance as much as possible. Many people are used to a deductible when they become Medicare-eligible, and a $283 deductible is often lower than their previous deductibles. As you'll see in the chart below - the Plan G covers almost all of the bills which are only partially covered by Medicare - and the deductible is very reasonable.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan G (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan G - they all work the same way and are responsible to pay the same bills.

What does Plan G cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay your $1,736 deductible - so that you pay $0.

Even if your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan G will pick up the daily hospital copays of $434 per day and $868 per day - savings you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan G coverage does not "run out" leaving you liable for the bill unless you go beyond 365 reserve days in the hospital - making it a very solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan G will pay the $217 for you up through the 100th day - and you pay $0.

It will pay the full cost of the first three pints of blood when covered under Medicare Part A - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan G will not pay your yearly deductible ($283 in 2026) - so that you pay the first $283.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B after you've met your $283 calendar-year deductible - and if you have Plan G, Plan G will pay the remaining 20% for you - so that you pay $0.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

specialists

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

and many, many more!

(You'll pay $0 for all of these services when approved by Medicare, after you've met your yearly $283 deductible).

Medicare Supplement Plan G will also pay any and all Medicare Part B excess charges - so you pay $0.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond medicare pricing. These doctors and providers do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan G will pay the remaining $80 (20% of $400). Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan G covers Part B Excess Charges, it pays the excess fee of $60 - and you pay $0.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified”)Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan G Covers Emergencies during Foreign Travel if incurred within the first 60 days while traveling outside of the US.

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

You'll pay the first $250 of emergency expenses outside of the US - this is your foreign travel deductible.

After your deducible is met, Plan G will pay 80% of the bills incurred for emergencies outside of the US, and you are responsible for the remaining 20%.

I've heard about a Hi-Deductible Plan G. Can I by that instead of regular Plan G?

Yes.

In 2015, congress passed a bill that we refer to as MACRA. MACRA stands for Medicare Access And Chip Reauthorization Act of 2015.

This act made some changes to Plan F and Plan C (see the Plan F and Plan C sections for details), and therefore eliminated the Hi-Deductible Plan F in 2020 for those who are not eligible for Medicare prior to January 2020.

After I purchase Medicare Supplement Plan G - can I ever lose Plan G?

All Medicare Supplement plans - including Plan G - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan G - you can keep it for life if you'd like to.

Should I buy Plan G?

Plan G is a great plan and we highly recommend it for anyone wanting to eliminate copays and have a policy with a very small deductible.

There are a lot of factors that go into a decision on which plan to get, and which company to get it from, so we highly recommend that you connect with our office and we can walk you through some specifics, based on your location, age, gender, etc.

We have a lot of clients who love Plan G - and if you decide that Plan G is the right plan for you, then we will certainly help you with enrollment and any future service needs.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan D written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

Plan N

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've covered Plan F and we also covered Plan G. Now, let's take a look at Plan N, as it is a very popular Medicare Supplement plan.

Medicare Supplement Plan N covers almost as much as Plan F and Plan G. Similar to Plan G - it will not cover your Medicare Part B deductible - so you pay your first $283 of expenses (in 2026. It also adds two copays - up to $20 for an office visit, and up to $50 for an ER visit. The $20 for the doctor will not be higher if you see a specialist, it is capped at $20. And, the $50 at the ER is waived if you get admitted to the hospital as an inpatient. Finally, it does not cover Part B excess charges.

Because Plan N often costs $20-30 less per month in premium dollars than Plan G, and $40-60 less than Plan F - many see the value in choosing to purchase Plan N, save $240-720 per year in premium, and pay the $283 deductible, $20 office copay, $50 ER copay, and any potential excess charges on their own (from the savings).

Why is Plan N Popular?

A lot of people choose to purchase a Medicare Supplement Plan N because they want to eliminate most of the major co-pays and co-insurance as much as possible. Many people are used to a deductible when they become Medicare-eligible, and a $283 deductible is often lower than their previous deductibles. As you'll see in the chart below - the Plan N covers almost all of the bills which are only partially covered by Medicare - and the deductible is very reasonable. The small remaining copays are very reasonable.

We've said before that the three most popular plans are Plan F, Plan G, and Plan N - and out of these three plans, Plan N is the least expensive!

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan N (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan N - they all work the same way and are responsible to pay the same bills.

What does Plan N cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay your $1,736 deductible - so that you pay $0.

Even if your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan N will pick up the daily hospital copays of $434 per day and $868 per day - savings you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan N coverage does not "run out" leaving you liable for the bill unless you go beyond 365 reserve days in the hospital - making it a very solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan N will pay the $217 for you up through the 100th day - and you pay $0.

It will pay the full cost of the first three pints of blood when covered under Medicare Part A - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan N will not pay your yearly deductible ($283 in 2026) - so that you pay the first $283.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B after you've met your $283 calendar-year deductible - and if you have Plan N, Plan N will pay the remaining 20% for you - so that you pay $0. There are only two exceptions where Plan N will not pay your 20% coinsurance - a doctor office copay and an ER copay.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits (this is one of the exceptions, where you'll pay up to $20).

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

emergency room (this is the second exception - you'll pay a $50 copay, unless you are admitted as an inpatient)

lab tests

preventative care covered under Medicare

and many, many more!

(You'll pay $0 for all of these services, except the two exceptions, when approved by Medicare, after you've met your yearly $283 deductible).

Medicare Supplement Plan N will not pay any Medicare Part B excess charges - so you pay the full amount if incurred.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and providers do not "accept assignment."

Example: You need to have Speech Therapy after having a stroke, and the provider does not accept assignment. Medicare's fee schedule allows the speech therapy center to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan N will pay the remaining $80 (20% of $400). Because the speech therapy center does not accept assignment, they are allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan N does not cover Part B Excess Charges, you'll pay the Part B Excess charge, which is $60 in this example.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified.” The math would work out closer to this:

- Medicare allowable: $400

- Medicare allowable for the non-par provider: $380 [95% of $400]

- Excess charge: $57 [15% of $380])Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan N Covers Emergencies during Foreign Travel if incurred within the first 60 days while traveling outside of the US.

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

You'll pay the first $250 of emergency expenses outside of the US - this is your foreign travel deductible.

After your deducible is met, Plan N will pay 80% of the bills incurred for emergencies outside of the US, and you are responsible for the remaining 20%.

After I purchase Medicare Supplement Plan N - can I ever lose Plan N?

All Medicare Supplement plans - including Plan N - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan N - you can keep it for life if you'd like to.

Should I buy Plan N?

Plan N is a great plan and we highly recommend it for anyone wanting to eliminate major copays and have a policy with a very small deductible. The two small copays ($20 at the doctor, and $50 at the ER) are reasonable. Because excess charges are fairly rare, we think Plan N has good value.

There are a lot of factors that go into a decision on which plan to get, and which company to get it from, so we highly recommend that you connect with our office and we can walk you through some specifics, based on your location, age, gender, etc.

We have a lot of clients who love Plan N - and if you decide that Plan N is the right plan for you, then we will certainly help you with enrollment and any future service needs.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan N written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

Plan A

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

But what if you want to explore some of the less traditional Medicare Supplement options?

The following is a list of the other plans which are not purchased as often as the widely popular F, G, and N plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Some agents will not sell these alternative plans - often because they are simply unfamiliar with them. While we recognize that these plans are not as popular, we also recognize that you are unique and you may want to explore one of these plan options.

So, let's handle these 9 alternative medicare supplement plans in alphabetical order - starting with Plan A.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan A (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan A - they all work the same way and are responsible to pay the same bills.

What does Plan A cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will not pay your $1,736 deductible - so that you pay $1,736 during each hospitalization.

If your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan A will pick up the daily hospital copays of $434 per day and $868 per day - savings you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan A coverage does not "run out" leaving you liable for the bill (except the deductible) unless you go beyond 365 reserve days in the hospital.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan A will not pay the $217 for you up through the 100th day - which can potentially leave you with a very large bill. Therefore, for skilled nursing, you pay $217 per day.

It will pay the full cost of the first three pints of blood - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan A will not pay your yearly deductible ($283 in 2026) - so that you pay $283.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B - and if you have Plan A, Plan A will pay the remaining 20% for you - so that you pay $0.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

specialists

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

and many, many more!

(You'll pay $0 for all of these services when approved by Medicare).

Medicare Supplement Plan A will not pay any Medicare Part B excess charges - so you pay all excess charges when incurred.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and provider do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan A will pay the remaining $80 (20% of $400). Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan A does not cover Part B Excess Charges, it will not pay the excess fee of $60 - so you pay $60.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified”)Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan A does not Cover Emergencies During Foreign Travel

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

Plan A is one of the Medicare Supplement plans which will not cover any emergencies while traveling abroad. If you plan to travel outside the US, then you may want to consider a different Medicare Supplement plan.

After I purchase Medicare Supplement Plan A - can I ever lose Plan A?

All Medicare Supplement plans - including Plan A - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan A - you can keep it for life if you'd like to.

Should I just buy Plan A - because it's inexpensive?

If you are looking for an inexpensive Medicare Supplement plan, and you don't plan to travel outside the US, and you are comfortable with the hospitalization deductible of $1,736, then Plan A may be a good fit. Don't forget that there is also no extra coverage with Plan A for skilled nursing care, which has a copay of $217 per day.

Call us and we'll check pricing for you in your zip code, based on your age and gender. Then, we can contrast Plan A with a different plan if you'd like, and if you see value in Plan A, then we will get you set up with a Medicare Supplement Plan A.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan A written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

Plan B

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

The following is a list of the other plans which are not purchased as often as the widely popular F, G, and N plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Some agents will not sell these alternative plans - often because they are simply unfamiliar with them. While we recognize that these plans are not as popular, we also recognize that you are unique and you may want to explore one of these plan options.

So, let's handle these 9 alternative medicare supplement plans in alphabetical order - We've already covered Plan A. Let's look at Plan B now.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan B (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan B - they all work the same way and are responsible to pay the same bills.

What does Plan B cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay your $1,736 Medicare Part A deductible - so that you pay $0.

If your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan B will pick up the daily hospital copays of $434 per day and $868 per day - savings you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan B coverage does not "run out" leaving you liable for the hospitalization bill unless you go beyond 365 reserve days in the hospital - making it a very solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan B will not pay the $217 for you up through the 100th day - which can potentially leave you with a very large bill. Therefore, for skilled nursing, you pay $217 per day.

It will pay the full cost of the first three pints of blood - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan B will not pay your yearly deductible ($283 in 2026) - so that you pay $283.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B - and if you have Plan B, Plan B will pay the remaining 20% for you - so that you pay $0.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

specialists

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

and many, many more!

(You'll pay $0 for all of these services when approved by Medicare).

Medicare Supplement Plan B will not pay any Medicare Part B excess charges - so you pay all excess charges when incurred.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and providers do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan B will pay the remaining $80 (20% of $400). Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan B does not cover Part B Excess Charges, it will not pay the excess fee of $60 - so you pay $60.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified”)Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan B does not Cover Emergencies During Foreign Travel

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

Plan B is one of the Medicare Supplement plans which will not cover any emergencies while traveling abroad. If you plan to travel outside the US, then you may want to consider a different Medicare Supplement plan.

After I purchase Medicare Supplement Plan B - can I ever lose Plan B?

All Medicare Supplement plans - including Plan B - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan B - you can keep it for life if you'd like to.

Should I just buy Plan B - because it's inexpensive?

If you are looking for an inexpensive Medicare Supplement plan, and you don't plan to travel outside the US, then Plan B may be a good fit. Don't forget that there is also no extra coverage with Plan B for skilled nursing care, which has a copay of $217 per day - we think that this is a pretty important area to have good coverage for.

Call us and we'll check pricing for you in your zip code, based on your age and gender. Then, we can contrast Plan B with a different plan if you'd like, and if you see value in Plan B, then we will get you set up with a Medicare Supplement Plan B.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan B written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

Plan C

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

The following is a list of the other plans which are not purchased as often as the widely popular F, G, and N plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Some agents will not sell these alternative plans - often because they are simply unfamiliar with them. While we recognize that these plans are not as popular, we also recognize that you are unique and you may want to explore one of these plan options.

So, let's handle these 9 alternative medicare supplement plans in alphabetical order - We've already covered Plan A and Plan B. Let's look at Plan C now.

Why do people like Plan C?

A lot of people choose to purchase a Medicare Supplement Plan C because they want to eliminate deductibles, co-pays, and co-insurance as much as possible. As you'll see in the chart for Plan C - the Plan C Medicare Supplement covers almost all of the bills which are only partially covered by Medicare.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan C (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan C - they all work the same way and are responsible to pay the same bills.

What does Plan C cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay your $1,736 deductible - so that you pay $0.

Even if your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan C will pick up the daily hospital copays of $434 per day and $868 per day - saving you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan C coverage does not "run out" leaving you liable for the bill unless you go beyond 365 reserve days in the hospital - making it a very solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan C will pay the $217 for you up through the 100th day - and you pay $0.

It will pay the full cost of the first three pints of blood - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan C will pay your yearly deductible ($283 in 2026) - so that you pay $0.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B - and if you have Plan C, Plan C will pay the remaining 20% for you - so that you pay $0.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

specialists

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

and many, many more!

(You'll pay $0 for all of these services when approved by Medicare).

Medicare Supplement Plan C will not pay any Medicare Part B excess charges - so you pay all excess charges if incurred.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and provider do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan C will pay the remaining $80 (20% of $400). Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan C does not cover Part B Excess Charges, it will not pay the excess fee of $60 - so you pay $60.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified” - the final bill would be closer to $57, not $60)Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan C Covers Emergencies during Foreign Travel if incurred within the first 60 days while traveling outside of the US.

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

You'll pay the first $250 of emergency expenses outside of the US - this is your foreign travel deductible.

After your deducible is met, Plan C will pay 80% of the bills incurred for emergencies outside of the US, and you are responsible for the remaining 20%.

I heard that Plan C is going away. Is that true? If I buy Plan C now, will they just take it away from me later?

Yes and No.

The answer is that, yes, Plan C went away for some people beginning in 2020 - but here is the truth. Let's get into the details.

In 2015, congress passed a bill that we refer to as MACRA. MACRA stands for Medicare Access And Chip Reauthorization Act of 2015. This law affected both Plan F and Plan C.

If you became eligible for Medicare Part A before January 1, 2020, then insurance companies are allowed to sell you Plan C indefinitely.

If you already enrolled in a Plan C, or are considering it, and you were eligible for Medicare prior to January 1, 2020, then you may purchase Plan C and keep it as long as you pay your premium.

The bottom line is this - only people who were not eligible for Medicare until on/after 1/1/2020 really "lost" the ability to purchase Plan C. If you were eligible for Medicare prior to 1/1/2020 - then you are eligible to purchase Plan C.

After I purchase Medicare Supplement Plan C - can I ever lose Plan C?

All Medicare Supplement plans - including Plan C - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan C - you can keep it for life if you'd like to.

Should I buy Plan C - because it covers almost everything - and not consider the other plan options?

Plan C is great and will provide you with excellent coverage if you enroll in it, but many times you can get more "bang for your buck" with Plan G or even Plan N. There are a lot of factors that go into a decision on which plan to get, and which company to get it from, so we highly recommend that you connect with our office and we can walk you through some specifics, based on your location, age, gender, etc.

We have a lot of clients who love the convenience of Plan C - and if you decide that Plan C is the right plan for you, then we will certainly help you with enrollment and any future service needs.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan C written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

PLAN D

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

There are 9 other Medicare Supplement plans - and we think there is value in considering those plans as well.

The following is a list of the nine other plans which are not purchased as often as the widely popular F, G, and N Plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Some agents will not sell these alternative plans - often because they are simply unfamiliar with them. While we recognize that these plans are not as popular, we also recognize that you are unique and you may want to explore one of these plan options.

So, let's handle these 9 alternative medicare supplement plans in alphabetical order - We've covered Plan A, Plan B, and Plan C. The next one on our list is Plan D.

Why do some people like Plan D?

A lot of people choose to purchase a Medicare Supplement Plan D because they want to eliminate co-pays and co-insurance as much as possible. Many people are used to a deductible when they become Medicare-eligible, and a $283 deductible is often lower than their previous deductibles. As you'll see in the chart below - the Plan D covers almost all of the bills which are only partially covered by Medicare - and the deductible is very reasonable. It's similar to Plan G - which is extremely popular, with one difference: Plan G covers Medicare Part B Excess Charges, and Plan D does not.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan D (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan D - they all work the same way and are responsible to pay the same bills.

What does Plan D cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay your $1,736 deductible - so that you pay $0.

Even if your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan D will pick up the daily hospital copays of $434 per day and $868 per day - savings you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan D coverage does not "run out" leaving you liable for the bill unless you go beyond 365 reserve days in the hospital - making it a very solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan D will pay the $217 for you up through the 100th day - and you pay $0.

It will pay the full cost of the first three pints of blood when covered under Medicare Part A - you pay $0.

It pays for the outpatient drug copay and the inpatient respite care copays during hospice - you pay $0.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan D will not pay your yearly deductible ($283 in 2026) - so that you pay the first $283.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B after you've met your $283 calendar-year deductible - and if you have Plan D, Plan D will pay the remaining 20% for you - so that you pay $0.

What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

specialists

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

and many, many more!

(You'll pay $0 for all of these services when approved by Medicare, after you've met your yearly $283 deductible).

Medicare Supplement Plan D will not pay any Medicare Part B excess charges - so you pay all incurred excess charges.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and provider do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan D will pay the remaining $80 (20% of $400). Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan D does not covers Part B Excess Charges, you will be responsible to pay the excess fee of $60 in this example.

(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified,” as the final bill would be closer to $57)Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan D Covers Emergencies during Foreign Travel if incurred within the first 60 days while traveling outside of the US.

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

You'll pay the first $250 of emergency expenses outside of the US - this is your foreign travel deductible.

After your deducible is met, Plan D will pay 80% of the bills incurred for emergencies outside of the US, and you are responsible for the remaining 20%.

After I purchase Medicare Supplement Plan D - can I ever lose Plan D?

All Medicare Supplement plans - including Plan D - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan D - you can keep it for life if you'd like to.

Should I buy Plan D?

Plan D is a great plan and we highly recommend it for anyone wanting to eliminate copays and have a policy with a very small deductible.

Plan D is a great alternative to Plan G. Does your Plan G cost too much? You may want to consider Plan D - which is very similar, but it does not cover Part B excess charges. Especially if you are in a state which does not allow excess charges: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

There are a lot of factors that go into a decision on which plan to get, and which company to get it from, so we highly recommend that you connect with our office and we can walk you through some specifics, based on your location, age, gender, etc.

We have a lot of clients who love Plan D - and if you decide that Plan D is the right plan for you, then we will certainly help you with enrollment and any future service needs.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan D written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

PLAN Hi-F (High-Deductible Plan F)

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

There are 9 other Medicare Supplement plans - and we think there is value in considering those plans as well.

The following is a list of the nine other plans which are not purchased as often as the widely popular F, G, and N Plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Some agents will not sell these alternative plans - often because they are simply unfamiliar with them. While we recognize that these plans are not as popular, we also recognize that you are unique and you may want to explore one of these plan options.

So, let's handle these 9 alternative medicare supplement plans in alphabetical order - We've covered Plan A, Plan B, Plan C, and Plan D. The next one on our list is Plan Hi-F, or High-Deductible Plan F.

The Basics of Hi-F

Hi-F, or High Deductible Plan F, is simply an alternative to the widely popular Plan F. Plan F is known for being the most comprehensive plan available to anyone on Medicare. Plan F pays the deductibles for both Medicare Part A and Part B, and Plan F pays the copays and coinsurance for both Medicare Part A and Part B.

If you are unfamiliar with "regular" Plan F - then we recommend that you take a look a the description above.

So how is Hi-F, or High-Deductible Plan F, different from "regular" Plan F?

Simply put, your Medicare Supplement is not responsible for paying any of the medical bills until you reach a $2,950 deductible.

Therefore, Medicare will pay their portion first, then you become the "next payer in line" until your out-of-pocket reaches $2,950, and then once you reach that threshold, your Hi-F supplement then is the final payer in line.

When will the deductible "reset"?

Many people are confused about how the Hi-F deductible works. If a policy is purchased in June, the deducible is met in November, shouldn't the plan cover extra expenses through May of the following year? No, unfortunately, that's not how the plan work. The deductible is a calendar year deductible, and the deductible amount re-sets each year on January 1. High-Deductible Plan F has a calendar year deductible, not a policy year deductible.

Why Hi-F, High-Deductible Plan F?

The number one reason that people will purchase Hi-F, or High-Deductible Plan F, is because of the monthly premium savings. Sometimes, Hi-F is close to $100 less per month than regular Plan F.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan Hi-F (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan Hi-F - they all work the same way and are responsible to pay the same bills.

After I purchase Medicare Supplement Plan Hi-F, High Deductible Plan F - can I ever lose Plan Hi-F?

All Medicare Supplement plans - including Plan Hi-F - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan Hi-F - you can keep it for life if you'd like to.

Should you buy Hi-F?

Our experience with Hi-F has been mixed over the years. Some of our clients love it. Others wish they would have purchased a better, or more comprehensive, insurance plan. While you may save some money by paying less per month for the insurance, there is a possibility that you will one day pay a lot more, because you will pay your premium and $2,950 in medical expenses as you meet your deductible.

With everything, it's a personal choice. If you decide that you'd like to purchase Hi-F, we will help you find the best Hi-F plan in your area. As always, we can do a full comparison for you, so that you can see multiple Hi-F quotes, all in one place.

Reach out to us anytime, and we'll be happy to help. 1-855-887-5050.

Article on Medicare Supplement Plan Hi-F, High-Deductible Plan F, written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

PLAN Hi-G (High-Deductible Plan G)

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

There are 9 other Medicare Supplement plans - and we think there is value in considering those plans as well.

The following is a list of the nine other plans which are not purchased as often as the widely popular F, G, and N Plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Some agents will not sell these alternative plans - often because they are simply unfamiliar with them. While we recognize that these plans are not as popular, we also recognize that you are unique and you may want to explore one of these plan options.

So, let's handle these 9 alternative medicare supplement plans in alphabetical order - We've covered Plan A, Plan B, Plan C, Plan D, and Hi-F. The next one on our list is Plan Hi-G, or High-Deductible Plan G.

The Basics of Hi-G

Hi-G, or High Deductible Plan G, is simply an alternative to the widely popular Plan G. Plan G pays the deductibles for Medicare Part A, but not for Part B, and Plan G pays the copays and coinsurance for both Medicare Part A and Part B.

If you are unfamiliar with "regular" Plan G - then we recommend that you take a look a the description above.

So how is Hi-G, or High-Deductible Plan G, different from "regular" Plan G?

Simply put, your Medicare Supplement is not responsible for paying any of the medical bills until you reach a $2,950 deductible. It also will not cover the $283 Medicare Part B deductible.

Therefore, Medicare will pay their portion first, then you become the "next payer in line" until your out-of-pocket reaches $2,950 (+$283 Part B Deductible), and then once you reach that threshold, your Hi-G supplement then is the final payer in line.

When will the deductible "reset"?

Many people are confused about how the Hi-G deductible works. If a policy is purchased in June, the deducible is met in November, shouldn't the plan cover extra expenses through May of the following year? No, unfortunately, that's not how the plan work. The deductible is a calendar year deductible, and the deductible amount re-sets each year on January 1. High-Deductible Plan G has a calendar year deductible, not a policy year deductible.

Why Hi-G, High-Deductible Plan G?

The number one reason that people will purchase Hi-G, or High-Deductible Plan G, is because of the monthly premium savings. Sometimes, Hi-G is close to $100 less per month than regular Plan G.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan Hi-G (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan Hi-G - they all work the same way and are responsible to pay the same bills.

After I purchase Medicare Supplement Plan Hi-G, High Deductible Plan G - can I ever lose Plan Hi-G?

All Medicare Supplement plans - including Plan Hi-G - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan Hi-G - you can keep it for life if you'd like to.

Should you buy Hi-G?

Our experience with Hi-G has been mixed over the years. Some of our clients love it. Others wish they would have purchased a better, or more comprehensive, insurance plan. While you may save some money by paying less per month for the insurance, there is a possibility that you will one day pay a lot more, because you will pay your premium and over $2,950 in medical expenses as you meet your deductible.

With everything, it's a personal choice. If you decide that you'd like to purchase Hi-F, we will help you find the best Hi-G plan in your area. As always, we can do a full comparison for you, so that you can see multiple Hi-G quotes, all in one place.

Reach out to us anytime, and we'll be happy to help. 1-855-887-5050.

Article on Medicare Supplement Plan Hi-F, High-Deductible Plan F, written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

PLAN K

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

There are 9 other Medicare Supplement plans - and we think there is value in considering those plans as well.

The following is a list of the nine other plans which are not purchased as often as the widely popular F, G, and N Plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M

Not many agents are familiar with these alternative plans. Ask 10 "medicare" agents to explain Plan K, and 9 will not be able to without looking up the outline of coverage first to review. This is mostly because Plan K is rarely sold. While we recognize that these plans are not as popular as others, we also recognize that you are unique and you may want to explore one of these plan options.

So, we are handling these 9 alternative medicare supplement plans in alphabetical order - We've covered Plan A, Plan B, Plan C, Plan D, and Plan Hi-F, and Hi-G. The next one on our list is Plan K.

The Basics of Medicare Supplement Plan K.

Plan K is an interesting little plan. It is less expensive than all three of the most popular plans, but it's more expensive than the cheapest plan which we detailed above (Hi-G, High-Deductible Plan G).

Plan K and Plan L are what I refer to as "percentage" Plans. As you'll see below, Medicare will pay their part, then in most instances, Plan K and Plan L will pay a percentage of the rest (rather than the full amount, or nothing).

A simple nickname for Plan K is "The 50% Plan" and you'll see why below.

Are there any restrictions - in other words, can I use any doctor? Can I travel and use this in other states?

With Medicare Supplement Plan K (as well as the other Medicare Supplement plans), you may use any doctor, hospital, or provider that accepts Medicare. It doesn't even matter which supplement company you choose to use to get Plan K - they all work the same way and are responsible to pay the same bills.

What does Plan K cover?

It fills in the "gaps" of Medicare Part A

If you are hospitalized, it will pay 50% of your $1,736 deductible - so that you pay $868.

If your hospitalization lasts longer than the initial 60 days covered by Medicare, Plan K will pick up the daily hospital copays of $434 per day and $868 per day - saving you thousands and thousands of dollars in bills from an extended hospital stay - you pay $0.

Plan K coverage does not "run out" leaving you liable for the bill unless you go beyond 365 reserve days in the hospital - making it a solid insurance policy.

If you are admitted to a Skilled Nursing Facility, after a 3-day hospital stay, Medicare will cover your first 20 days. But what if you need to stay longer than 20 days? There begins to be a copay of $217 per day. Plan K will pay 50% of the $217 for you up through the 100th day - and you pay $108.50 per day.

It will pay the 50% of the cost of the first three pints of blood when covered under Medicare Part A - you pay 50%.

It pays 50% of the outpatient drug copay and the inpatient respite care copays during hospice - you pay 50%.

It fills in the "gaps" of Medicare Part B

Medicare Part B has a yearly deductible - and Plan K will not pay your yearly deductible ($283 in 2026) - so that you pay the first $283.

Any Medicare-approved Part B expenses are usually covered at 80% by Medicare Part B after you've met your $283 calendar-year deductible - and if you have Plan K, which we nickname "The 50% Plan," Plan K will cover 50% of the remaining 20% for you. What is 50% of 20%? Well, 10% of course.

In other words, Medicare pays 80%, and the remaining 20% is split between you and Plan K, so that the Supplement Plan pays 10% of the total bill, and you pay 10% of the bill.What kinds of things are "Part B expenses?"

Part B expenses include a lot of different expenses. Let's name a few common expenses:doctor's office visits

chiropractors for spine manipulation

chemotherapy treatment

ambulance

outpatient surgery

physical therapy

emergency room

lab tests

preventative care covered under Medicare

and many, many more!

(You'll pay 10% for all of these services when approved by Medicare, after you've met your yearly $283 deductible).

Medicare Supplement Plan K will not pay any Medicare Part B excess charges - so you pay the full amount if incurred.

What is a Medicare Part B Excess charge?

Doctors and other providers, in certain states, are allowed to charge up to 15% above and beyond the standard medicare pricing. These doctors and provider do not "accept assignment."

Example: Dr. Roberts does not accept assignment. He is a specialist and sees you for a visit. Medicare's fee schedule allows Dr. Roberts to charge $400 for this visit. Therefore, Medicare will pay $320 (80% of $400), and Plan K will pay it's portion - which is $40 (10% of $400, which is the same as 50% of the $80 balance), and you will pay $40. Because Dr. Roberts does not accept assignment, he is allowed to charge an excess fee of 15% - which is $60. Because your Medicare Supplement Plan K does not cover Part B Excess Charges, you'll also pay the Part B Excess charge of $60 in this example.(Technically, the excess fee would be less as doctors who don’t accept assignment are then only reimbursed at 95% and are then allowed 15% excess of the 95%, but the above example is “simplified” - the actual final bill would be closer to $57)

Why are Medicare Part B Excess Charges legal?

If a doctor or provider contracts with Medicare - many believe that the doctor or provider should accept Medicare's pay schedule. In most states, however, they are allowed to charge excess charges, and if you do not have insurance to cover the excess charges, then you could end up paying the excess charge portion of the bill.Two points we should clarify:

Excess charges are not common. Opinions differ on the exact percentage of providers who charge Part B excess charges - but most statistics show 5% or less. If you'd like to avoid being charged excess charges, ask your provider, "Do you accept assignment?" If they do, then they should not charge Part B excess charges.

Some states have outlawed Medicare Part B Excess charges. This is called the MOM Law - or the Medicare Overcharge Measure. If you get care in the following states, then you do not need to be concerned about Medicare Part B excess charges in that state: Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont

Plan K does not Cover Emergencies During Foreign Travel

When you have Medicare A & B, it is good coverage while you are within the United States. But many of our clients travel - sometimes outside of the US. What happens when you travel outside the US and need emergency medical attention?

Plan K is one of the Medicare Supplement plans which will not cover any emergencies while traveling abroad. If you plan to travel outside the US, then you may want to consider a different Medicare Supplement plan.

Do Medicare Supplements have an Out-of-Pocket limit? Yes, there are two plans with out-of-pocket limits. Plan K has an out-of-pocket limit.

We often get asked, "what is the out-of-pocket limit on my Medicare Supplement?" Most Medicare supplements are so good as far as coverage goes that they do not need to have an out-of-pocket limit. But, Plan K is a little bit different, primarily because it will not provide you with full coinsurance coverage on your Part B expenses.

As noted above, Part B expenses encompass many different areas of healthcare. So, if someone buys a Plan K, which only pays 50% of the remaining 20% (in other words, 10% of the total), then the person may have a concern that paying for 10% of their medical bills could become very expensive.

Because of this risk, Plan K has built-in protection. In 2026, Plan K has an out-of-pocket limit of $8,000. While $8,000 is still a lot of money, it is better than having no safety net at all.

So, to summarize, Plan K is one of the least expensive Medicare Supplement plans, and it gives you some "immediate" coverage and help, paying a portion of what remains after Medicare pays. Because it's not "full" coverage like Plan F or even Plan G or N, it gives you a safety net so that you know your expenses cannot soar above the yearly out-of-pocket limit.

After I purchase Medicare Supplement Plan K - can I ever lose Plan K?

All Medicare Supplement plans - including Plan K - are guaranteed renewable. That means, if you like your plan, you can keep it and no one can take it away from you or cancel you for any reason other than non-payment.

In the highly unlikely event that a Medicare Supplement company goes out of business, then you have guaranteed provisions to allow you to purchase a new plan from another company without health questions.

In short - if you buy Plan K - you can keep it for life if you'd like to.

Should I buy Plan K?

Plan K is an interesting alternative to the Hi-G, High-Deductible Plan G. The Hi-G plan (see details above) doesn't provide you with as many immediate benefits as Plan K does. And with Plan K being only slightly higher in Premium to Plan Hi-G, we think that it's a good alternative for those who want to keep their Medicare Supplement costs as low as possible, without sacrificing all immediate benefits. Just remember, Hi-G has a deductible, and Plan K does not have a deductible.

There are a lot of factors that go into a decision on which plan to get, and which company to get it from, so we highly recommend that you connect with our office and we can walk you through some specifics, based on your location, age, gender, etc.

Plan K has never been overly popular, but we have had a few clients purchase Plan K and they've been happy with the coverage and the low premium. If you think it may be the one for you, we'd be happy to help you enroll in Plan K with a company offering it for a low premium.

Call us anytime - 1-855-887-5050.

Article on Medicare Supplement Plan K written by Scott Shafran, License Independent Agent, Helping people with Medicare since 2010. Scott Shafran is the owner of StartMedicareRight.com.

PLAN L

Introduction: The three most popular Medicare Supplement Plans are Plan F, Plan G, and Plan N. We've already looked at those above.

There are 9 other Medicare Supplement plans - and we think there is value in considering those plans as well.

The following is a list of the nine other plans which are not purchased as often as the widely popular F, G, and N Plans:

Plan A

Plan B

Plan C

Plan D

Plan Hi-F

Plan Hi-G

Plan K

Plan L

Plan M